6 Simple Techniques For Eb5 Investment Immigration

Eb5 Investment Immigration for Beginners

Table of ContentsThe Definitive Guide for Eb5 Investment ImmigrationThe 45-Second Trick For Eb5 Investment ImmigrationEb5 Investment Immigration Things To Know Before You BuyThe 25-Second Trick For Eb5 Investment Immigration7 Easy Facts About Eb5 Investment Immigration Explained

Contiguity is established if census systems share borders. To the degree feasible, the consolidated demographics systems for TEAs ought to be within one city location without greater than 20 demographics tracts in a TEA. The consolidated demographics systems must be a consistent form and the address should be centrally located.For more information about the program see the united state Citizenship and Migration Services site. Please enable thirty day to refine your request. We generally respond within 5-10 company days of getting certification requests.

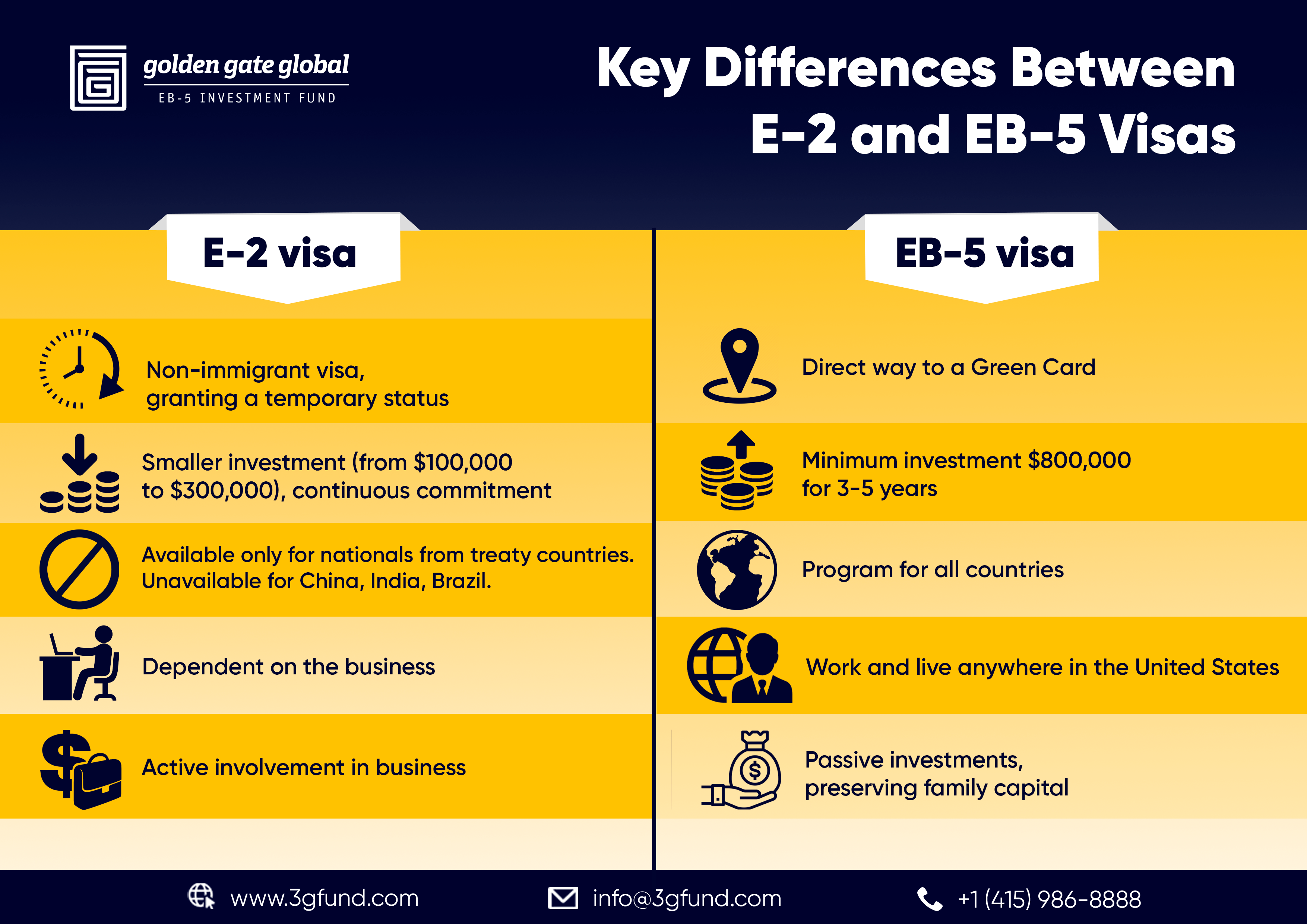

The U.S. federal government has taken steps intended at enhancing the degree of international financial investment for nearly a century. This program was expanded through the Immigration and Citizenship Act (INA) of 1952, which developed the E-2 treaty investor class to additional bring in international financial investment.

workers within two years of the immigrant investor's admission to the United States (or in specific circumstances, within a reasonable time after the two-year period). Furthermore, USCIS might credit investors with maintaining work in a distressed service, which is specified as a venture that has been in presence for a minimum of two years and has endured a bottom line throughout either the previous twelve month or 24 months prior to the top priority date on the immigrant investor's preliminary request.

Some Known Details About Eb5 Investment Immigration

(TEA), which consist of specific marked high-unemployment or rural locations., which certifies their international capitalists for the lower investment threshold.

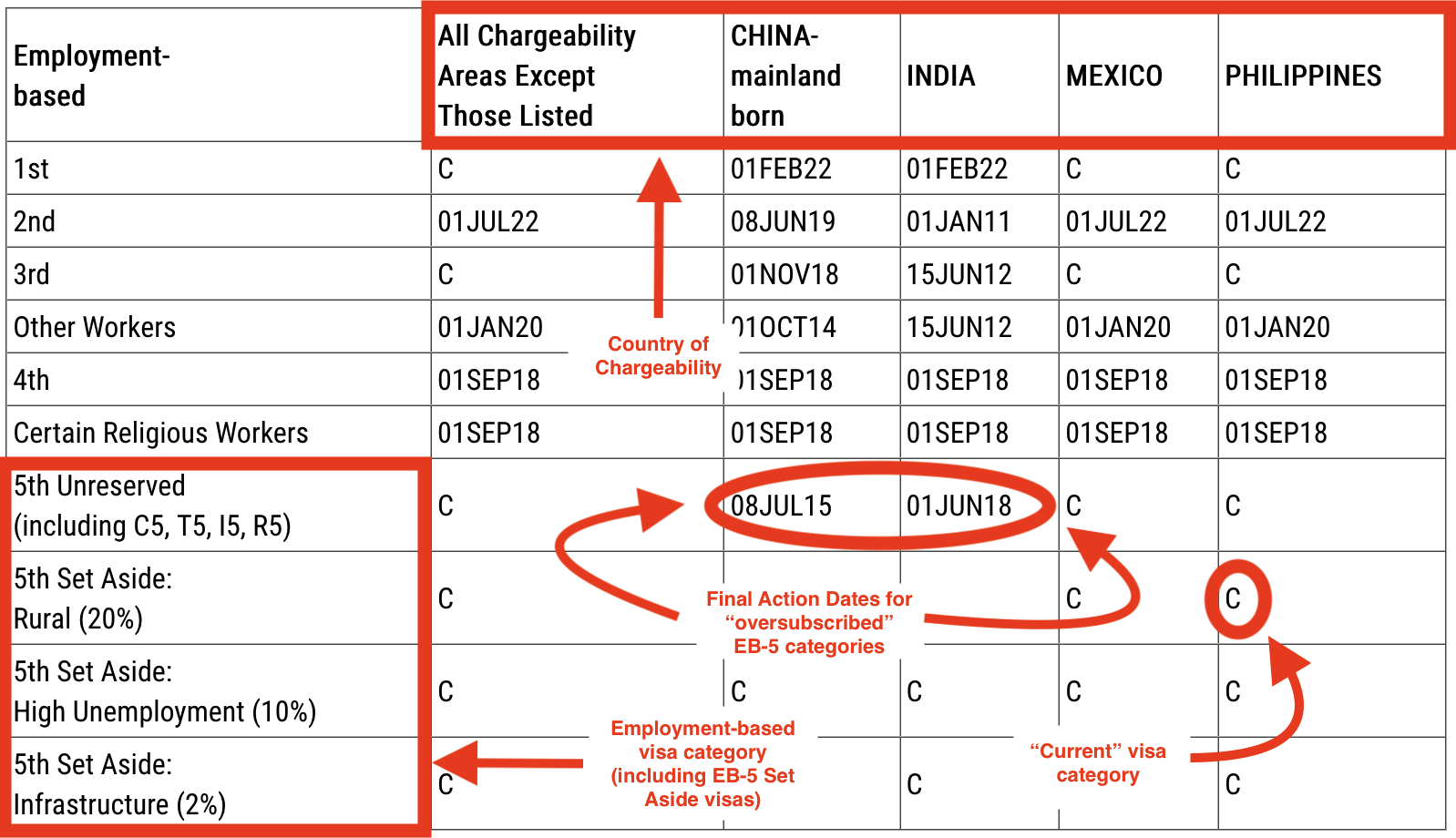

To certify for an EB-5 visa, a financier should: Invest or be in the procedure of investing at the very least $1.05 million in a brand-new commercial venture in the United States or Spend or be in the process of spending at least $800,000 in a Targeted Employment Location. One method is by setting up the financial investment company in a financially challenged area. You might contribute a minimal commercial financial investment of $800,000 in a rural area with much less than 20,000 in population.

Not known Factual Statements About Eb5 Investment Immigration

Regional Center financial investments allow for the consideration of financial effect on the regional economic situation in the type of indirect work. Reasonable economic techniques can be used to establish enough indirect work to meet the employment production need. Not all regional centers are produced equivalent. Any kind of investor thinking about spending with a Regional Facility should be extremely mindful to take into consideration the experience and success rate of read the company before spending.

The investor first needs to submit an I-526 application with U.S. Citizenship and Immigration Provider (USCIS). This petition should include review proof that the financial investment will develop permanent work for a minimum of 10 U.S. residents, irreversible residents, or other immigrants who are licensed to function in the USA. After USCIS accepts the I-526 petition, the financier may obtain a permit.

Excitement About Eb5 Investment Immigration

If the investor is outside the United States, they will certainly require to go through consular handling. Capitalist eco-friendly cards come with conditions affixed.

The brand-new area usually allows good-faith financiers to keep their eligibility after termination of their local facility or debarment of their NCE or JCE. After we inform investors of the termination or debarment, they might retain eligibility either by alerting us that they proceed to fulfill qualification needs regardless of the termination or debarment, or by changing their petition to show that they fulfill the demands under section 203(b)( 5 )(M)(ii) of the INA (which has various needs depending on whether the financier is seeking to preserve qualification since their regional facility was terminated or because their NCE or JCE was debarred).

In all situations, we will certainly make such decisions consistent with USCIS plan about submission to prior decisions to guarantee regular adjudication. After we terminate a local center's designation, we will certainly revoke any kind of Type I-956F, Application for Approval of a Financial Investment in a Business, associated with the terminated local center if the Type I-956F was accepted as of the day on the local center's discontinuation notification.

Things about Eb5 Investment Immigration